An Unbiased View of Retirement Planning copyright

An Unbiased View of Retirement Planning copyright

Blog Article

Fascination About Investment Representative

Table of ContentsThe 9-Second Trick For Retirement Planning copyrightThe Basic Principles Of Investment Representative The Definitive Guide to Financial Advisor Victoria BcInvestment Consultant for BeginnersThe smart Trick of Lighthouse Wealth Management That Nobody is Talking AboutGetting My Investment Representative To WorkThe Single Strategy To Use For Retirement Planning copyrightThe Only Guide to Tax Planning copyrightAbout Tax Planning copyright

They generate money by battery charging a payment for each trade, an appartment monthly fee or a portion paid regarding the buck number of assets becoming handled. Buyers seeking ideal consultant should ask a number of concerns, including: an economic expert that actually works with you will likely not function as same as a financial expert just who works closely with another.Depending on whether you’re in search of a wide-ranging economic plan or are simply in search of financial investment advice, this question would be vital. Financial experts have different ways of asking their customers, and it will frequently be determined by how many times you use one. Make sure you ask if specialist comes after a fee-only or commission-based program.

Not known Facts About Investment Representative

When you may need to place in some try to find the correct economic specialist, the work could be worth every penny if advisor offers solid information and helps put you in a far better budget.

Vanguard ETF Shares aren't redeemable straight making use of the issuing account besides in huge aggregations really worth vast amounts (https://www.wattpad.com/user/lighthousewm). ETFs tend to be at the mercy of market volatility. When buying or offering an ETF, you'll shell out or receive the current market price, that might be almost than internet resource price

Excitement About Ia Wealth Management

Usually, however, a financial expert have some type of instruction. If it’s not through an academic system, it is from apprenticing at a financial advisory company (https://www.webtoolhub.com/profile.aspx?user=42376041). People at a firm who happen to be nevertheless mastering the ropes in many cases are called colleagues or they’re an element of the administrative team. As mentioned previous, though, numerous experts come from various other fields

Retirement Planning copyright Fundamentals Explained

What this means is they have to place their clients’ needs before their, on top of other things. Other monetary analysts tend to be members of FINRA. This will imply that these include brokers who in addition provide expense advice. As opposed to a fiduciary criterion, they lawfully must follow a suitability standard. This means you will find a reasonable foundation due to their financial investment suggestion.

Their particular names typically state it-all:Securities certificates, however, are more regarding the income part of investing. Economic advisors who're also brokers or insurance policies agencies tend to have securities permits. As long as they immediately buy or sell shares, bonds, insurance rates items or provide financial guidance, they’ll require particular permits about those products.

Rumored Buzz on Investment Consultant

Make sure to ask about financial advisors’ cost schedules. To get this info on your own, check out the firm’s Form ADV which files with all the SEC.Generally talking, there's two forms of pay structures: fee-only. investment representative and fee-based. A fee-only advisor’s main type settlement is via client-paid charges

When trying to understand simply how much an economic consultant costs, it’s important to know there are a number of settlement practices they might use. Here’s an introduction to everything you might come across: Financial advisors will get compensated a share of your own total possessions under control (AUM) for controlling your money.

Lighthouse Wealth Management Things To Know Before You Get This

59per cent to at least one. 18%, on average. lighthouse wealth management. Generally speaking, 1per cent is seen as a requirement for as much as a million dollars. Many analysts will reduce the percentage at higher degrees of possessions, therefore you’re investing, say, 1per cent for any first $1 million, 0. 75per cent for the next $4 million and 0

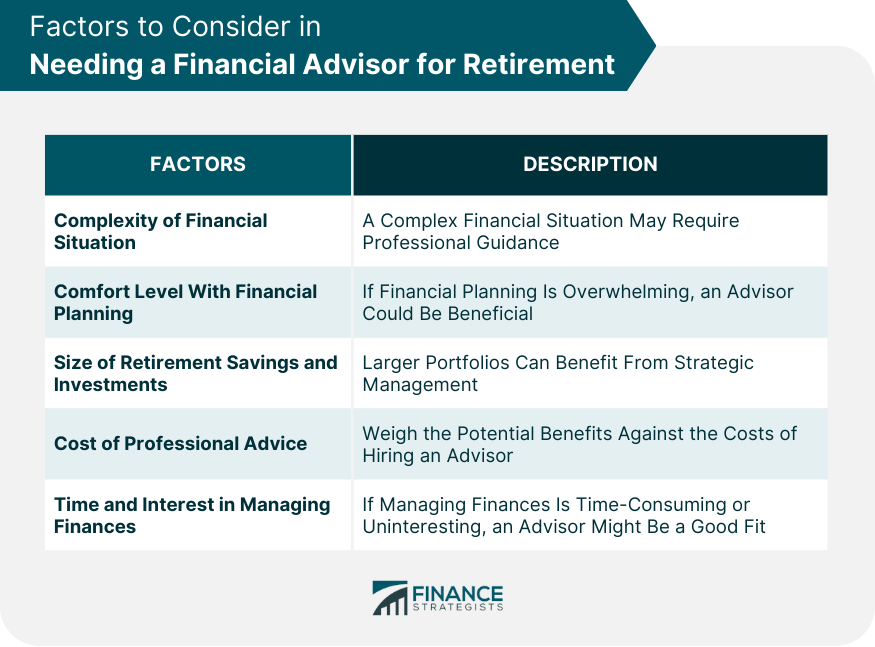

Whether you require a financial specialist or not is determined by just how much you really have in assets. Select the comfort and ease with cash control subject areas. When you have an inheritance or have not too long ago come into extreme sum of money, after that a financial expert could help answr fully your economic concerns and arrange your cash.

Examine This Report on Retirement Planning copyright

Those differences could seem evident to individuals in the investment sector, but many consumers aren’t conscious of all of them. They could contemplate financial planning as similar with expense administration and guidance. Also it’s true that the lines between the occupations have cultivated blurrier in past times number of years. Investment analysts are progressively dedicated to supplying holistic economic planning, as some customers look at the investment-advice piece become more or less a commodity and are also seeking broader knowledge.

If you’re pursuing holistic preparation guidance: a monetary coordinator is suitable if you’re seeking broad financial-planning guidanceon your own investment profile, but the rest of your own plan nicely. Search for those people that name on their own economic planners and inquire potential coordinators if they’ve received the qualified economic planner or chartered monetary consultant designation.

About Retirement Planning copyright

If you'd like expense information most importantly: If you think debt plan is in sound condition as a whole you need visit homepage assistance choosing and supervising your own opportunities, a financial investment consultant will be the way to go. These types of individuals are usually registered investment experts or are employed by a strong definitely; these advisors and advisory organizations are held to a fiduciary requirement.

If you'd like to assign: This setup makes good sense for extremely busy people who simply don't have the time or inclination to participate in during the planning/investment-management process. It is also something to think about for older people who are concerned about the potential for cognitive drop and its particular impact on their capability to handle unique finances or investment portfolios.

10 Easy Facts About Retirement Planning copyright Explained

The author or authors usually do not own shares in almost any securities mentioned here. Learn about Morningstar’s article guidelines.

Exactly how near you're to retirement, for example, or even the influence of major existence activities particularly matrimony or having kiddies. But these matters aren’t under the command over a monetary planner. “Many occur arbitrarily and additionally they aren’t one thing we can impact,” states , RBC Fellow of Finance at Smith class of company.

Report this page